STRATEGY

Lighthouse Partners is focused on acquiring newer construction (1990’s and newer) apartment buildings with a projected hold period of 5-7 years. We are selectively pursuing opportunities in the major metro’s of the Western US and properties that offer some component of light value add and operational upside. Our targeted deal size is between $5-30M (total capitalization). In addition to multifamily properties, Lighthouse Partners is interested in acquiring self-storage facilities and mobile home parks.

Acquisition Criteria

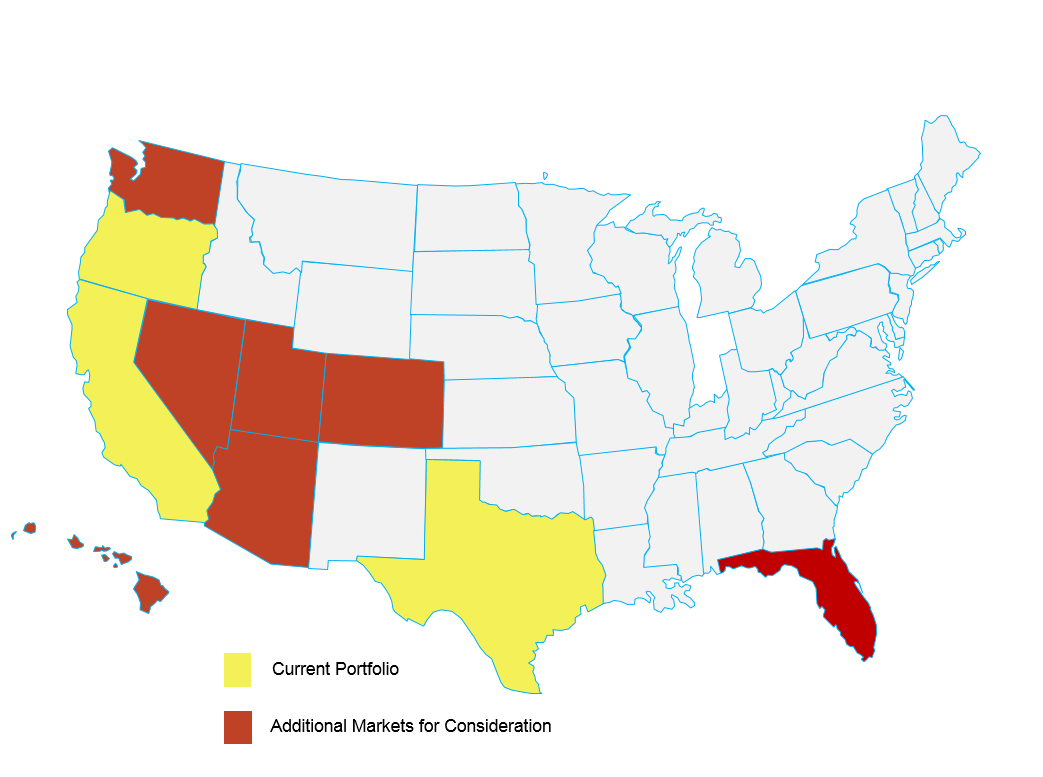

Lighthouse Partners is primarily focused on high quality, well located apartment communities throughout the Western United States.

LOCATION Primary markets within California, Oregon, Washington, Utah, Colorado, Texas and Hawaii

AGE: Communities built after 1990 (CA and HI 1980 and after)

INVESTMENT TYPE: Core, core-plus or value-add

SIZE: Projects between $5 - $35 Million

BROKERS: Lighthouse Partners actively pursues both listed and off-market opportunities. Brokers will be protected and paid on off-market deals.

EQUITY INVESTMENTS: Lighthouse Partners will also consider providing LP investment capital Co-GP investment for select opportunities.

Please contact us for additional acquisition parameters:

[email protected]

Portfolio Map